Key Financial Tips for Navigating Economic Shifts

Introduction

Navigating economic shifts can often feel like steering a ship through turbulent seas. Economic changes impact personal finances, requiring astute navigation and timely adjustments. This article offers key financial tips to help manage and thrive during such shifts.

RDNE Stock project/Pexels

Advertisement

Understanding Economic Indicators

Awareness of economic indicators is crucial. Metrics like inflation, interest rates, and employment figures can give insights into economic conditions. By keeping an eye on these indicators, you can make informed financial decisions.

Lukas/Pexels

Advertisement

Focus on Building an Emergency Fund

An emergency fund provides a safety net against economic uncertainties. Aim to save three to six months' worth of living expenses. This fund helps cover essentials if unexpected financial storms hit, providing peace of mind and stability.

Yusuf Timur Çelik/Pexels

Advertisement

Diversify Income Streams

Relying on a single income source can be risky during economic shifts. Explore additional income opportunities, such as freelance work or investments. Diversifying income streams cushions against unforeseen job losses or income disruptions.

Photo By: Kaboompics.com/Pexels

Advertisement

Cut Unnecessary Expenditures

Scrutinize your expenses and identify areas to trim. Prioritize essential costs and avoid impulsive purchases. Reducing discretionary spending increases financial resilience, ensuring you have more funds to weather challenging times.

Advertisement

Review and Adjust Your Financial Goals

Economic shifts may require reassessing financial goals. Regularly review financial objectives and adapt them to current circumstances. Adjusting goals allows efficient allocation of resources and alignment with your current priorities.

RDNE Stock project/Pexels

Advertisement

Reduce and Manage Debt

Debt can become burdensome during economic downturns. Focus on paying down high-interest debts first. Implement a debt reduction strategy, such as the snowball or avalanche methods, to diminish financial stress.

Mikhail Nilov/Pexels

Advertisement

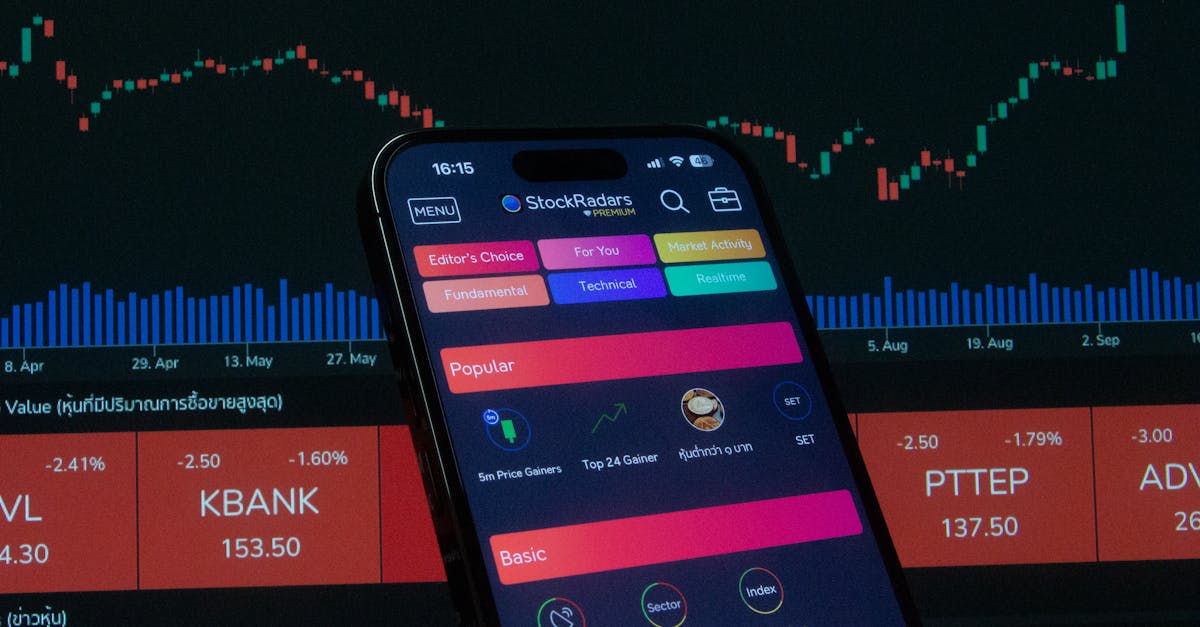

Invest Wisely During Economic Shifts

Market volatility often accompanies economic shifts, offering both risks and opportunities. Consider long-term investment strategies and diversify your portfolio. Consult financial advisors to steer investments wisely, minimizing potential losses.

StockRadars Co.,/Pexels

Advertisement

Stay Informed and Educated

Staying informed about economic changes and financial advice is paramount. Read relevant articles and attend seminars to enhance financial literacy. Being knowledgeable helps in making sound decisions and better preparing for economic variations.

Julia M Cameron/Pexels

Advertisement

Conclusion

Economic shifts offer both challenges and opportunities. By building an emergency fund, diversifying income, and investing wisely, you can secure financial stability. Remaining informed and adaptable ensures you navigate economic shifts effectively.

Kampus Production/Pexels

Advertisement